Loan Against Property vs. Personal Loan: Which is Better?

In the realm of personal finance, choosing the right type of loan can make a significant difference in managing your financial needs effectively. Two popular options that borrowers often consider are Loan Against Property (LAP) and Personal Loans. While both serve the purpose of providing funds, they differ in several aspects. This blog will help you understand these differences and determine which option might be better for your financial situation.

What is a Loan Against Property (LAP)?

A Loan Against Property (LAP) is a secured loan where borrowers can pledge their residential or commercial property as collateral to obtain funds. The loan amount is typically a percentage of the property’s market value, usually ranging from 50% to 70%.

Key Features of LAP:

Secured Loan: Requires collateral in the form of property.

Lower Interest Rates: Generally lower than personal loans due to the secured nature.

Higher Loan Amounts: Can borrow larger amounts compared to personal loans.

Longer Tenure: Repayment periods can extend up to 15-20 years.

Usage Flexibility: Funds can be used for various purposes like business expansion, education, medical expenses, etc.

What is a Personal Loan?

A Personal Loan is an unsecured loan provided by financial institutions based on the borrower’s creditworthiness. It does not require any collateral and is typically used for immediate financial needs.

Key Features of Personal Loans:

Unsecured Loan: No collateral required.

Higher Interest Rates: Usually higher than secured loans due to the increased risk for lenders.

Lower Loan Amounts: Typically, the loan amounts are lower compared to LAP.

Shorter Tenure: Repayment periods usually range from 1 to 5 years.

Quick Processing: Faster approval and disbursal process.

Comparison: Loan Against Property vs. Personal Loan

Interest Rates:

Loan Against Property: Interest rates for LAP are lower as the loan is secured against property.

Personal Loan: Interest rates are higher due to the unsecured nature of the loan.

Loan Amount:

Loan Against Property: Allows for higher loan amounts, which can be up to 70% of the property’s market value.

Personal Loan: Offers lower loan amounts, usually limited by the borrower’s income and creditworthiness.

Repayment Tenure:

Loan Against Property: Provides longer repayment tenures, making monthly installments more affordable.

Personal Loan: Shorter repayment periods, leading to higher monthly installments.

Processing Time:

Loan Against Property: Involves property valuation and legal checks, resulting in a longer processing time.

Personal Loan: Faster processing and approval, suitable for urgent financial needs.

Eligibility and Requirements:

Loan Against Property: Requires ownership of a property, and the property’s condition and location can affect loan approval.

Personal Loan: Primarily depends on the borrower’s credit score, income, and repayment capacity.

Which is Better?

The choice between a Loan Against Property and a Personal Loan depends on your specific financial needs and circumstances:

Choose LAP if:

You need a larger loan amount.

You are comfortable pledging your property as collateral.

You prefer lower interest rates and longer repayment tenures.

You have substantial time for loan processing and disbursement.

Choose Personal Loan if:

You need funds urgently.

You do not want to risk your property as collateral.

You require a smaller loan amount.

You prefer a quicker loan approval process.

-

Previous Post

One Step Loan Solution

Post a comment Cancel reply

Related Posts

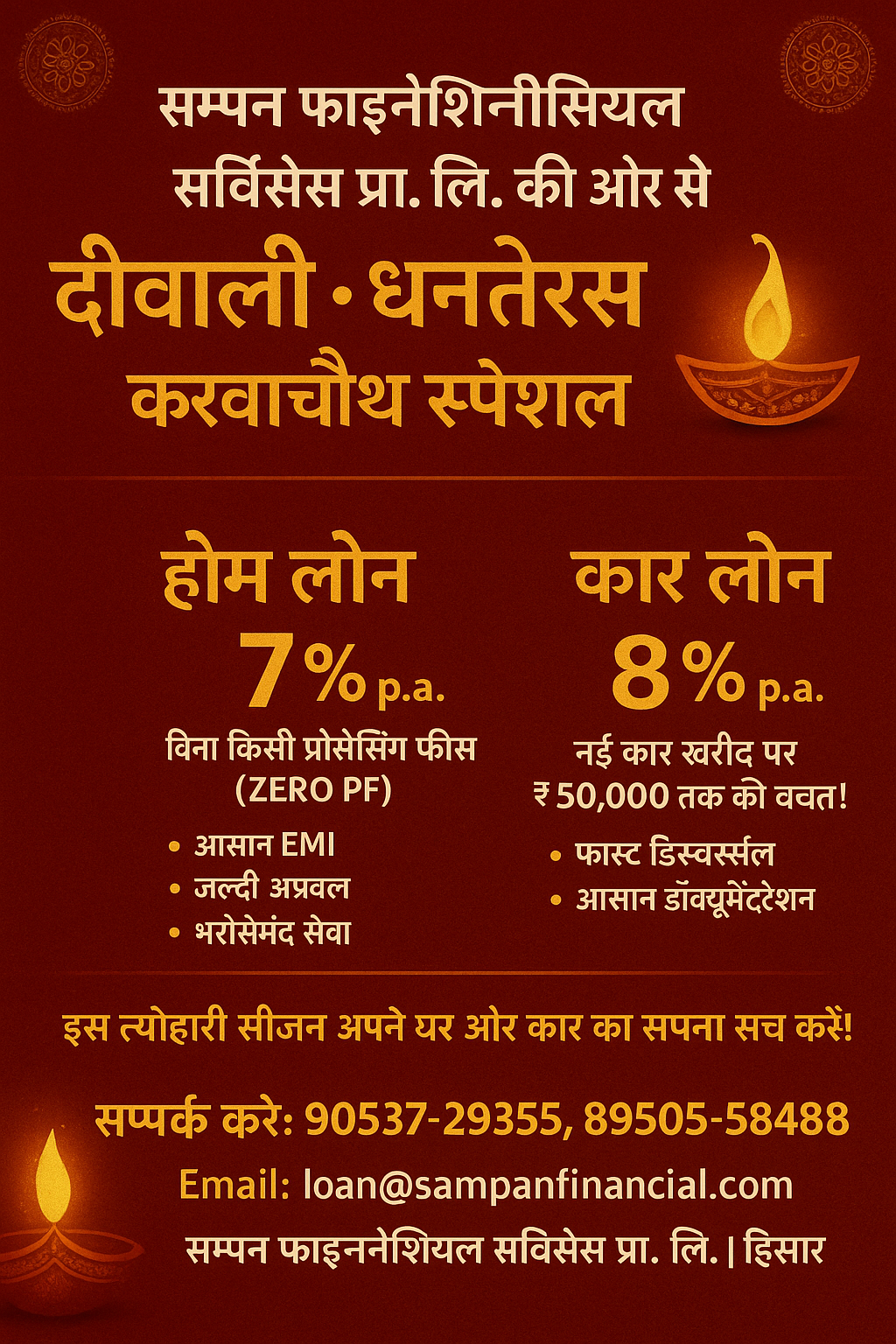

🎆 ✨ DIWALI DHAMAKA OFFER ✨ 🎆

🎆 ✨ DIWALI DHAMAKA OFFER ✨ 🎆From Sampan Financial Services Pvt. Ltd. 🚗 Car Loan…

विजयदशमी (Dussehra) की हार्दिक शुभकामनाएं 🎉

विजयदशमी (Dussehra) की हार्दिक शुभकामनाएं 🎉 ✨ Sampan Financial Services Pvt. Ltd. की ओर से…

🇮🇳 महात्मा गांधी जयंती की हार्दिक शुभकामनाएं 🇮🇳

🇮🇳 महात्मा गांधी जयंती की हार्दिक शुभकामनाएं 🇮🇳 ✨ Sampan Financial Services Pvt. Ltd. ✨…

🌍💰 World Financial Planning Day 💰🌍

🌍💰 World Financial Planning Day 💰🌍 Sampan Financial Services Pvt. Ltd. ✨ We advise you…

Colors

Colors  Quick Loan

Quick Loan  WhatsApp

WhatsApp